this post was submitted on 11 Sep 2023

30 points (100.0% liked)

Climate - truthful information about climate, related activism and politics.

5239 readers

404 users here now

Discussion of climate, how it is changing, activism around that, the politics, and the energy systems change we need in order to stabilize things.

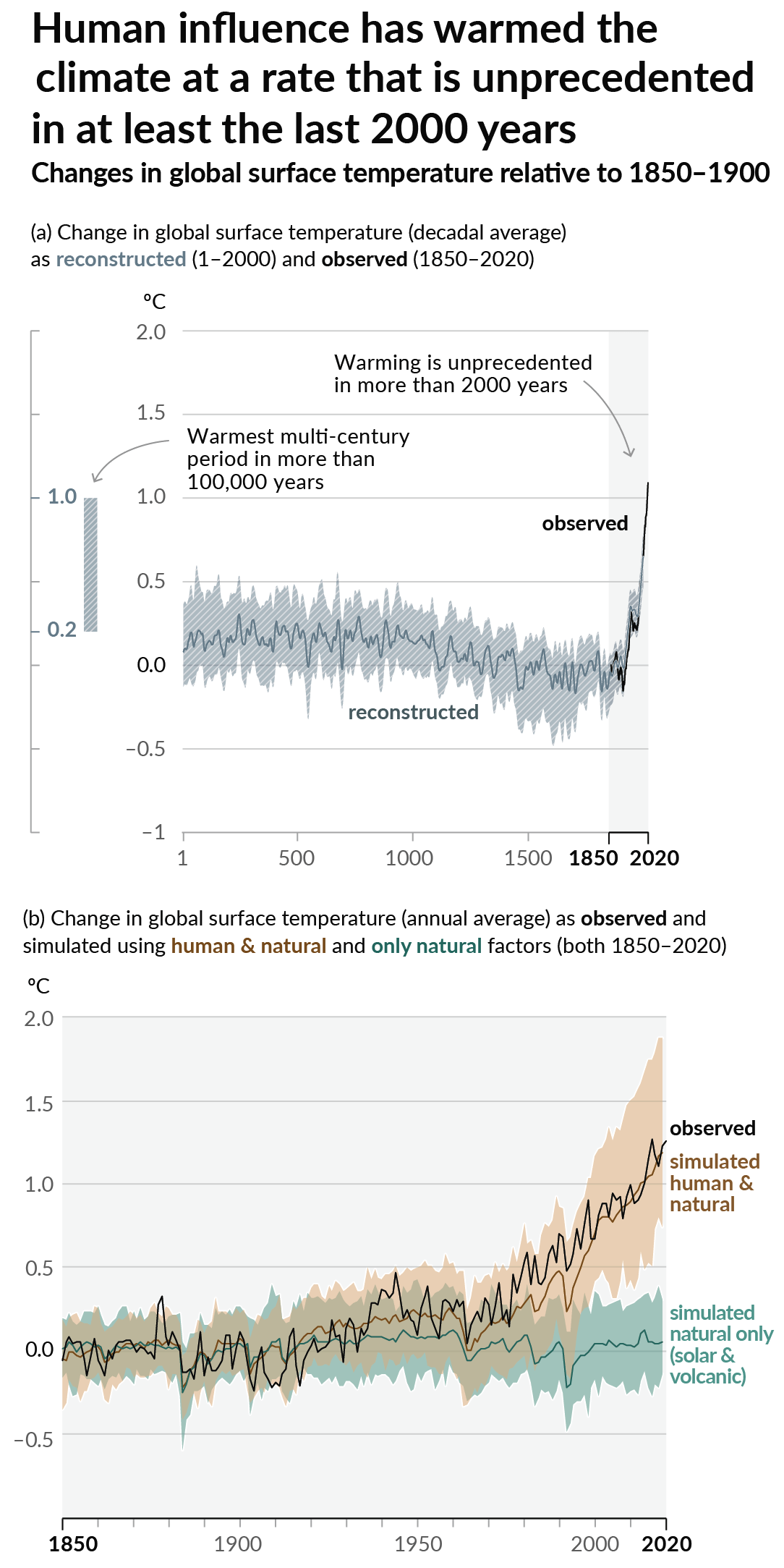

As a starting point, the burning of fossil fuels, and to a lesser extent deforestation and release of methane are responsible for the warming in recent decades:

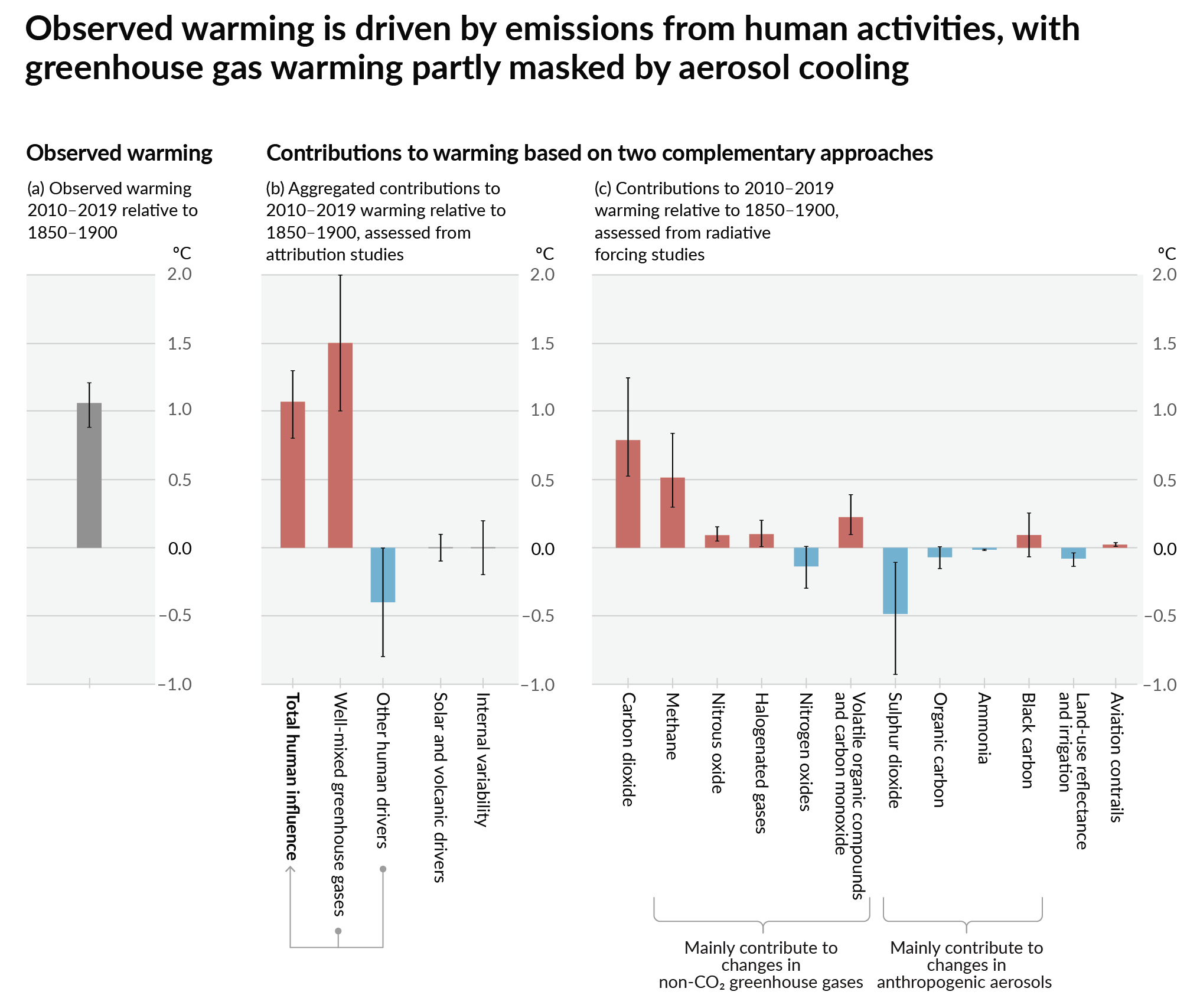

How much each change to the atmosphere has warmed the world:

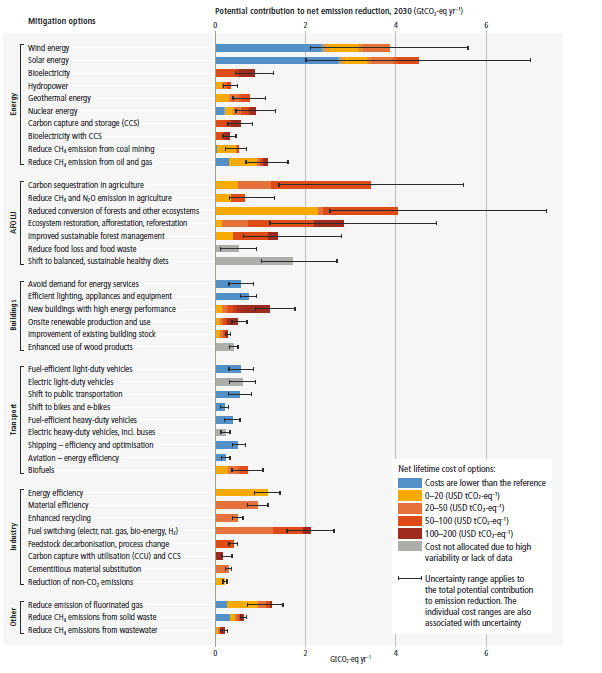

Recommended actions to cut greenhouse gas emissions in the near future:

Anti-science, inactivism, and unsupported conspiracy theories are not ok here.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

I've been trying to highlight this issue in conversations around fire risk. Its easy to want to throw the big bad evil insurance companies under the bus, because they are, well, big, bad, and evil. Sure. But what they are not is bad at math. They (along with reinsurance) have very carefully calculated their risk exposure in places like the California west, and determined that at the current prices they can not make a buck. Hate them all you want, sure. But recognize them for what they are and try and understand why they are choosing to not 'make money' in some situations.

Couple this with something like the California FAIR plan. This is the insurer of last resort in California. A kind of quasi private insurance company whose losses are subsidized like by the regulated marketplace. California recently passed a law requiring insurers give discounts for mitigation. However, if you read through and do the background research on the mitigations, few of them are backed up by any kind of reproducible study to determine if they are effective at reducing risk. The FAIR plan is the worst of these. Their standards show almost no indication that the mitigation actions will reduce risk (with some exceptions like the 0-5 foot zone management). The discounts are expected to come in at between 10-15%. So now you have even more burden from the riskiest of carries being pushed onto the regulated market place by the FAIR plan (depending on how many people take up the subsidy, which I think will be many). Couple this with the fact that the FAIR plan has put on 150k new policies in the last few years (I think they are currently standing at about 350k insured).

This is why State Farm pulled out. This is why Geico isn't writing new policies. Its a bad bet that you are almost certain to lose money on and insurance companies arent in the business of making bad bets.

I've heard industry insider speculation that at around 500k on the FAIR plan, the whole system goes tits up. My guess is that its actually around 420-440k. When this happens all the major insurers and reinsursers will pull out because the risk is just too high.

Any mortgage that requires PMI will go belly up. Property values will plummet. Cats will be sleeping with dogs. Bedlam I tell you.

What home owners don't want to hear though is that this is about how you manage your risk. Wildfire risk can be mitigated but it requires individuals to take meaningful action to reduce their risk. Whole communities have to act in concert to change their behavior.

Not even about making a buck, but about surviving. Why write a policies for an area when claims that will likely happen would bankrupt the company? That's what happened to a lot of small insurance companies way back when Andrew hit Florida (it's the first time I recall news about insurance companies running away). I think they are a necessary evil and will take you for everything if you aren't careful, but I can't fault them for seeing the obvious. At their core is the math, and the math is saying hell no.