TLDR: BC NDP gets 68 rental housing built in one of the most expensive neighborhoods in Canada for 10 Christy Clark(Previous BC United leader) yoga events i.e ~1.5m and people are not happy.

The NDP government provided a $31.8 million low-interest loan to Vancouver developer Jameson Development Corp. for the 68-unit rental building through the HousingHub program

His ministry said in a statement that the financing used to build the project at 1807 Larch St. will be fully paid back to the province, plus interest

The problem starts here where CBC did a segment that just interviewed a bunch of people to see what bad things they had to say about the project.

https://www.youtube.com/watch?v=WfpEXRjpybk

Deranged person A)

B.C. Green party leader Sonia Furstenau said that's "infuriating."

"People who need housing are not the people who can afford $4,200 a month in rent," she told CBC News

Deranged person B)

Andy Yan, an urban planner and director of Simon Fraser University's City Program, asked what the public interest was in subsidizing developers who are still charging rents that are out of reach for 75 per cent of Vancouver renters.

"It's an issue of what you're paying for versus what you're getting," Yan said.

The BC Conservative that used to be a Vancouver councilor: I genuinely can't make sense of whatever this person was trying to say. It was pretty much a human equivalent of someone slamming their keyboard a few times.

https://news.bchousing.org/new-affordable-rental-homes-on-the-way-in-kitsilano/

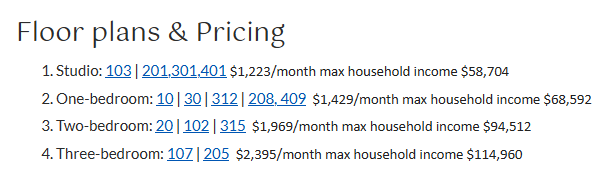

80% of units, totaling 54, will target at- or below-market level rents restricted to middle- income households within the provincial middle-income limits. Floor plans and prices.

20% of units, totaling 14, will be tenanted at moderate-income rent levels and to households earning less than $80,000 per year.

I haven't been able to find the exact figures but I've largely seen numbers like 2-3% better than market rates. I'm going to just be generous and round it up 5% accounting for some level defaults, that's 1.6m to produce 54 market rate rentals plus 14 below market rentals. People spend more than that on a single duplex.

If we scale that out to the original 2B program that would be 3,780 market rentals and 980 below market for only 5% opportunity cost of 2B. As someone who's gone over how hard it would be to build truly low cost housing that about as close as it gets.

$2,000,000,000 * 5% = $100,000,000

$100,000,000 /4,760 = 21k per unit

I think you deleted a sentence or something. Your 5% number is to do with the opportunity cost? So you're saying that the project cost Vancouver 5% of 31.8M ie 1.6M. That makes sense.

I think comparing it to the cost of a single duplex is a good way to provide context.

But the city didn't buy the units, they only catalyzed their construction. So it's not a perfect analogy.

Another short coming of your analysis is that the estimated cost of the loan is ignoring the risk of default. What if the contractor spends the money, but fails to complete the project? Or builds it but cuts a bunch of corners and gets sued into bankruptcy?

The risk of that is the real cost of the project. But overall I like your analysis, thanks for bringing it up.