While it would probably be a good idea to look at their sources more carefully, this is the kind of analysis I'd like to see more of.

It's true that with almost every type of emissions reduction, there is a point of diminishing returns where it becomes prohibitive to address those last few percent. From a policymaker's standpoint, they have to decide how much society is willing to pay and then attempt to optimize the allocation of resources within that framework. That's where you get your cap-and-trade and so forth.

This article suggests the lower up-front cost of renewables like wind and solar show a windfall up to 57%, but are still cost-competitive even up to 90%. This is encouraging. They mention the remaining 10% includes hard-to-decarbonize sectors like aviation. I think even in general electrical production though, there are diminishing returns.

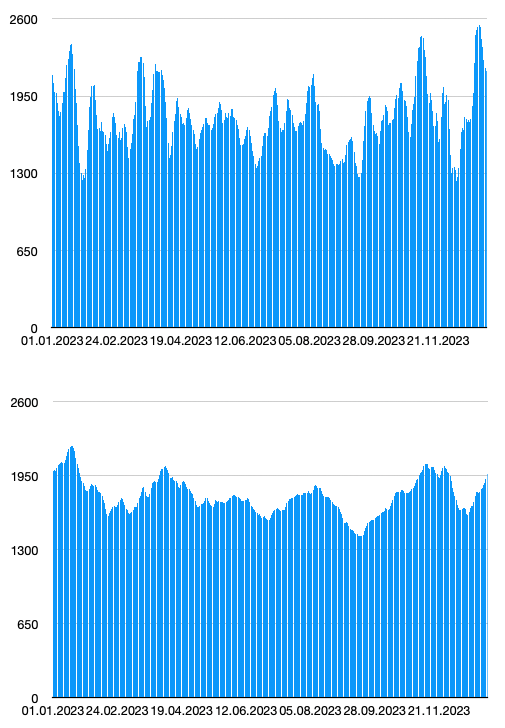

If you consider that to overcome the challenge of variability in supply with wind and solar, you need to invest in grid storage, there is the question of just how much storage you need? A day's worth? A week's worth? A month's worth? The more storage you have, the more edge cases you will cover, but your costs go up exponentially and may never reach 100%. If you reach say 99%, that's still around 3 days out of the year when you have to fire up some backup generators. Is that an acceptable compromise?